Super Micro Computer announced on Wednesday that it expects to miss the deadline for filing its annual report (Form 10-K) for the fiscal year ending June 30, 2024, with the U.S. Securities and Exchange Commission (SEC), and anticipates submitting a notice of late filing (Form 12b-25) regarding the annual report on August 30, 2024.

Media reports indicate that the company stated that management requires additional time to complete the assessment of the effectiveness of the design and operation of the internal control over financial reporting as of June 30, 2024. Super Micro Computer has not yet updated its financial performance for the fiscal year and quarter ended June 30, 2024, which was previously announced in a press release on August 6, 2024.

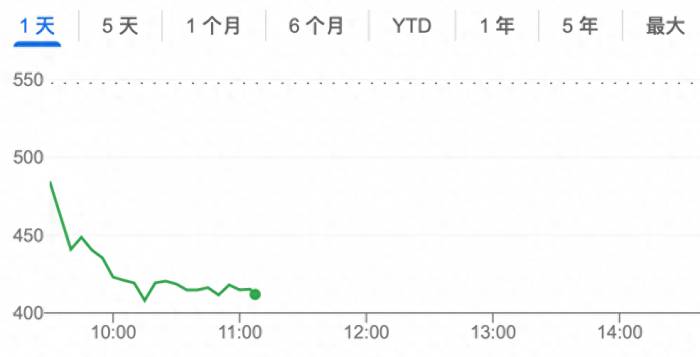

Shares of Super Micro Computer fell approximately 9% in pre-market trading and dropped 19% within the first ten minutes of opening on Wednesday, with the morning decline exceeding 26% at its peak, marking the largest single-day drop since March 16, 2020. Despite this, the stock still rose by 58%.

The plunge dragged down a host of AI stocks; there have been previous instances.

Nvidia is set to release its highly anticipated earnings report after the market closes on Wednesday, with investors widely expecting its performance to continue its strong momentum. Super Micro Computer has a close business relationship with Nvidia, allowing the company to capitalize on the surging demand for AI servers. Because of Super Micro Computer's tight connection with AI stocks, its sharp decline on Friday also led to a drop in AI and chip concept stocks, with Nvidia falling as much as 4.4%, Arm falling 5.69%, AMD falling 2.81%, and Intel falling 2.17%.

Advertisement

In fact, Super Micro Computer had previously caused a sharp drop in its own stock and a collapse of closely related AI stocks such as Nvidia in April of this year when it broke with its usual practice of announcing earnings.

A previous article from Wall Street Journal stated that on April 19th of this year, Super Micro Computer announced in a brief press release that it would announce its third-quarter earnings on April 30th. However, the company broke with its previous practice of providing preliminary earnings, which triggered investor concerns and led to a massive sell-off of the stock, resulting in a 23% plunge that day. At the time, the market generally believed that Super Micro's lack of a positive pre-announcement was considered negative.

Super Micro's sharp decline at the time also dragged down a host of tech stocks, with chip stocks and AI concept stocks being the hardest hit, suffering a severe drop on Friday. None of these tech companies had released any news that could have caused a stock price plunge.

Nvidia plummeted 10% that day, the Nvidia double long ETF fell 20%, "Nvidia concept stock" SoundHound fell over 7%, Arm fell nearly 17%, AMD fell over 5%, Meta fell over 4%, Intel fell 2.4%, and Microsoft and Apple fell over 1.2%.

There was also an instance last August when Super Micro's stock plummeted by more than 23% in a single day, which also dragged Nvidia down nearly 5% that day.The day before, it was targeted by a well-known short-selling firm.

Analysts believe that the timing of this series of events is quite delicate, as just the day before, the well-known short-selling firm Hindenburg Research announced that it was shorting Super Micro Computer's stock, accusing Super Micro Computer of having a history of accounting misconduct, and involving "undisclosed related party transactions, sanctions, and export control failures." It is currently unclear whether these two are related. When asked by the media about the allegations of being shorted by Hindenburg, Super Micro Computer refused to comment on anything beyond the statement made on Wednesday.

Previous articles by Wall Street News stated that Hindenburg Research's report pointed out that Super Micro Computer had certain accounting misconduct. In 2018, Super Micro Computer was temporarily delisted by NASDAQ for failing to submit the necessary financial statements. Subsequently, the U.S. Securities and Exchange Commission (SEC) accused the company of "widespread accounting violations" related to improper revenue recognition of over $200 million and underestimation of expenses, which led to inflated sales, earnings, and profit margins. Hindenburg pointed out that less than three months after reaching a $17.5 million settlement with the SEC, Super Micro Computer began to rehire executives involved in the previous scandal.

Hindenburg's report further claims that shortly after the SEC settlement, Super Micro Computer resumed practices such as "improper revenue recognition," "recognition of incomplete sales," and "circumventing internal accounting controls." The report suggests that the pressure of sales quotas led to problematic behaviors such as "partial shipments" and shipping defective products. Former employees reported that the company's internal culture has not improved since the SEC's allegations.

Transactions between Super Micro Computer and related parties have also sparked controversy. The report states that the relationship between Super Micro Computer and both disclosed and undisclosed related parties involves suspicious transactions. Disclosed related party suppliers Ablecom and Compuware, which are controlled by the brothers of CEO Liang Jianxun and partially owned by Liang himself, have received $983 million from Super Micro Computer in the past three years. These entities provide components to Super Micro Computer and then resell them back, leading to concerns about circular transactions and accounting integrity.

The report also reviewed Super Micro Computer's latest investments and contracts. In February 2024, Super Micro Computer made an undisclosed investment in tech startup Lambda Labs and signed a $600 million California data center lease contract, subleasing the space to Lambda. In addition, Super Micro's undisclosed investments and transactions with other companies, including Leadtek and a Turkish shell company, have also raised alarms.

Furthermore, concerns about Super Micro Computer's compliance with U.S. export restrictions are increasing. Although the company claims to have stopped selling products to Russia after the Russia-Ukraine conflict in February 2022, data shows that the company's export of high-tech components to Russia has significantly increased, and many companies that handle Super Micro products are now under U.S. sanctions.

In addition to these issues, the report also points out that Super Micro Computer faces challenges in maintaining key partnerships. Nvidia, a major chip supplier, publicly supported Super Micro's competitor Dell in May 2024. CoreWeave and Tesla, once important customers of Super Micro Computer, have shifted their business to Dell, further affecting Super Micro Computer's market position.

"In summary, we believe that Super Micro is a recidivist. It has benefited greatly from being a pioneer, but still faces significant accounting, governance, and compliance issues, and provides inferior products and services, and is now being eroded by more reliable competitors."

Post a comment