On August 21st, after the U.S. stock market closed, insiders revealed that Walmart (WMT.N) is transferring its stake in JD.com in an effort to raise no more than $3.74 billion.

Bloomberg reported that Walmart is looking to transfer 144.5 million shares of JD.com, with the large block trade being quoted at a price of $24.85 to $25.85 per share, and Morgan Stanley is the securities broker entrusted with this transaction by Walmart.

Neither representatives from Walmart nor JD.com have commented on the news. If the news is true, and the transaction is completed at the high end of the reported price range, Walmart would realize $3.74 billion from this deal; even at the low end, Walmart would still gain $3.59 billion.

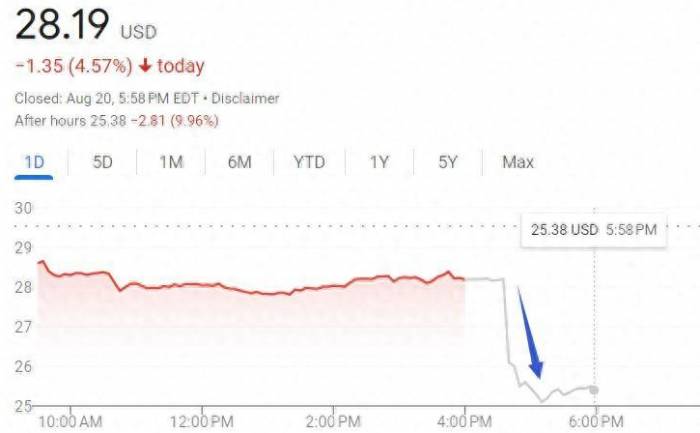

JD.com's stock price plummeted after hours, with the drop exceeding 10% at one point.

There was no official announcement from JD.com after the market closed.

According to investment insiders close to the transaction, this deal is likely a move by Walmart to alleviate its own financial pressure. Due to a slowdown in revenue growth and reduced cash flow in the second quarter, Walmart needs to respond to the current market environment changes with a diversified strategy. Exiting the equity investment in JD.com to release resources and optimize capital allocation is a normal capital operation and does not involve the strategic cooperation between the two parties.

Advertisement

On Tuesday, JD.com closed down nearly 4.6%, falling away from the high reached at the close on Monday, which was the third consecutive trading day of gains since June 12th. Based on Tuesday's closing price, the selling price of Walmart's shares is equivalent to a discount of up to 11.8% compared to Tuesday, and even at the low end of the quoted price, Walmart's minimum discount is 8.3%.

As a major shareholder holding more than 5% of JD.com, Walmart has not filed any documents with the U.S. Securities and Exchange Commission (SEC) disclosing the reduction transaction plan mentioned by the media on Tuesday.

Some media have reported that the 144.5 million shares Walmart plans to sell come from the JD.com equity it obtained in 2016 when it sold Yihaodian.

In June 2016, JD.com and Walmart jointly announced a deep strategic cooperation, with Walmart's Yihaodian being integrated into JD.com, and Walmart obtaining about 5% equity in JD.com. According to the agreement reached at the time, Walmart received about 144.5 million newly issued Class A common shares of JD.com, which is about 5% of JD.com's total share capital, and the transaction price was about $1.5 billion based on JD.com's stock price at the time.Subsequently, Walmart's stake in JD.com quickly rose, and by October 2016, its shareholding exceeded 10%.

JD.com's annual report for 2023, released earlier this year, shows that as of March 31 of this year, JD.com's founder, Richard Liu, held a total of 11.2% of JD.com's equity and 70.5% of the voting rights, while Walmart held 9.4% equity and 3.1% of the voting rights.

Compared to the end of February last year, Richard Liu's equity stake in JD.com decreased by 1.5 percentage points, and his voting rights decreased by 3.4 percentage points. Walmart's shareholding remained unchanged, but its shareholding ratio increased by 0.2 percentage points, and its voting rights increased by 0.3 percentage points.

Before the news broke on Tuesday this week that Walmart was seeking to sell over 100 million shares, JD.com had just released its better-than-expected Q2 financial report last Thursday.

In the second quarter, JD.com's operating revenue was 291.4 billion yuan, a year-on-year increase of 1.2%, higher than the analysts' expected 290.51 billion yuan. The adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for the quarter was 13.53 billion yuan, a year-on-year increase of 30%, far exceeding the analysts' expected 11.69 billion yuan.

After the financial report, JD.com's U.S. stocks closed up nearly 8.5% on Friday, and its Hong Kong stocks rose by about 9%.

Although JD.com's Q2 financial report was generally positive, Morgan Stanley later released a report pointing out that, against the backdrop of weak consumption and increasingly fierce e-commerce competition, JD.com's revenue growth of only 1.2% year-on-year should attract market attention.

Morgan Stanley's report stated that in the first half of the year, JD.com and JD Retail's revenue grew by 3.9% year-on-year, slightly higher than the 3.7% growth rate of China's total retail sales of consumer goods announced by the National Bureau of Statistics of China. The report expects that there will be no significant recovery in JD.com's revenue growth in the second half of the year. In the third and fourth quarters, JD Retail's revenue is expected to grow by 4.4% and 4.7%, respectively, with a full-year expected growth of 4.2%.

At the same time, Morgan Stanley cautiously lowered its revenue forecast for JD.com, reducing its revenue expectations for 2025 and 2026 by 5% and 10%, respectively, reflecting Morgan Stanley's conservative view on JD.com's recovery in growth momentum in the face of fierce industry competition.

Post a comment