The artificial intelligence (AI) boom has given the veteran computer giant Dell a "rejuvenation," with the business of AI servers accelerating double-digit growth in the latest quarter, offsetting the decline in personal computer (PC) business and delivering a more impressive report card than Wall Street expected.

On Thursday, August 29, Eastern Time, Dell Technologies announced the financial data for the second quarter (hereinafter referred to as Q2) of the fiscal year 2025, as well as the performance guidance for the third quarter (Q3) and the full year.

1) Main financial data:

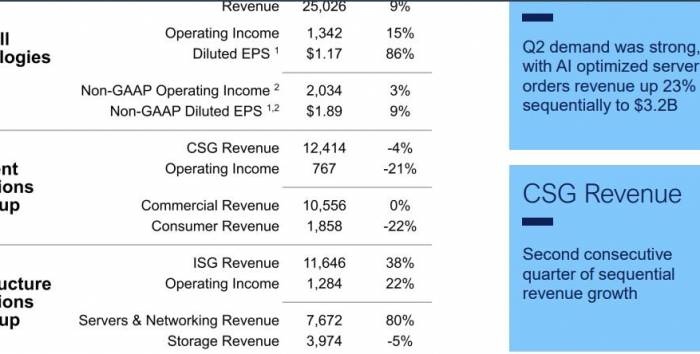

- Operating revenue: Q2 revenue was $25.03 billion, a year-over-year increase of 9%, with analysts expecting $24.12 billion. Dell's own guidance range was between $23.5 billion and $24.5 billion, with a year-over-year increase of 6% in the previous quarter.

- EPS: The diluted earnings per share (EPS) for Q2 was $1.17, an 86% increase year-over-year, with a 67% increase in the previous quarter. Under non-GAAP measures, the diluted EPS for Q2 increased by 9% to $1.89, with Dell's guidance range at $1.55 to $1.75, and a 3% decrease in the previous quarter.

Advertisement

2) Business segment data:

- ISG: Infrastructure Solutions Group (ISG) revenue for Q2 was $11.65 billion, a year-over-year increase of 38%, with analysts expecting $10.58 billion. In the previous quarter, the year-over-year increase was 22%. Within ISG, server and networking revenue for Q2 was $7.7 billion, a year-over-year increase of 80%.

- CSG: The Client Solutions Group (CSG) revenue for Q2 was $12.4 billion, a 4% decrease year-over-year, with zero growth in the previous quarter. Within CSG, commercial customer revenue for Q2 was $10.6 billion, unchanged from the level of a year ago.

3) Performance guidance:

- Operating revenue: The estimated revenue for Q3 is between $24 billion and $25 billion, with a midpoint of $24.5 billion, representing a 10% year-over-year increase, and analysts' expectations are at $24.6 billion.EPS: The company expects diluted non-GAAP EPS of $2.0 for the third quarter, with a fluctuation of $0.1, ranging from $1.9 to $2.1 billion.

Following the release of the financial report, Dell's stock price, which closed down over 0.7% on Thursday, quickly jumped in the after-hours trading, with a peak increase of more than 8%.

AI server demand increased by 23% quarter-over-quarter, while consumer PC revenue declined by 22% year-over-year.

In the second quarter, Dell's total revenue accelerated compared to the first quarter, thanks to the more robust growth in the Infrastructure Solutions Group (ISG), which includes AI servers. The year-over-year growth rate of ISG in the second quarter increased by nearly 73% compared to the first quarter, and it continued to set a new record for single-quarter revenue for this business. Among them, the revenue from server and networking business grew by 80%, almost double the growth rate of the first quarter.

Dell specifically mentioned that the demand for servers continued to outpace the shipment speed in the second quarter, with strong demand for AI servers. The revenue from AI-optimized server orders increased by 23% quarter-over-quarter to $3.1 billion. Dell's management revealed that the value of AI servers shipped in the second quarter was $3.1 billion.

In contrast, PCs are still holding Dell back. In the second quarter, the revenue of the Client Solutions Group (CSG), where PCs are located, not only failed to return to positive growth but also declined by 4% year-over-year, mainly due to a 22% decrease in consumer PC revenue and zero growth in commercial PC revenue.

Jeff Clarke, Dell's Vice Chairman and Chief Operating Officer (COO), commented on the second-quarter performance, stating that the company once again demonstrated its execution capabilities and the ability to provide strong cash flow, with AI continuing to drive new growth. He said:

"Our AI momentum accelerated in the second quarter, and we saw an increase in the number of enterprise customers purchasing AI solutions every quarter. The demand for AI-optimized servers was $3.2 billion, a 23% increase quarter-over-quarter, and $5.8 billion so far this year. The backlog of orders for (AI servers) is $3.8 billion, and our (sales) pipeline has grown to several times the backlog."

Dell's Chief Financial Officer (CFO), Yvonne McGill, mentioned the prospects of AI PCs boosting the computer business, stating that she expects the CSG business to turn to growth in the second half of the year, especially in the fourth quarter. "The upcoming PC refresh cycle and the long-term impact of AI will bring tailwinds to the PC market."

Post a comment