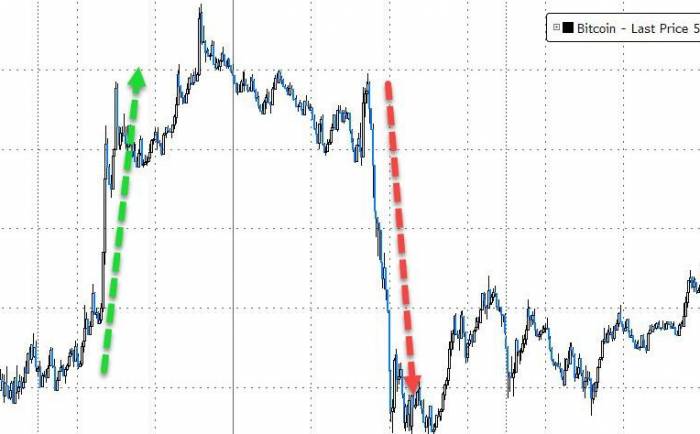

Financial media outlet ZeroHedge has written that while traders are actively betting on further declines in Bitcoin prices, surprises may be in store in the coming days or weeks, as the derivatives market is setting up a situation that could trigger a short squeeze.

According to the latest analysis by K33, a research-led digital asset brokerage firm, Bitcoin's perpetual swap funding rates have been negative in recent weeks, coinciding with a surge in open interest. This combination indicates a substantial amount of short positions in the market, structurally creating a situation prone to a short squeeze.

K33 analyst Vetle Lunde wrote in a report to investors on Tuesday: "This indicates aggressive short action, structurally creating a setup conducive to a short squeeze."

As reported by Decrypt, K33's short squeeze prediction relies on the 7-day average perpetual swap funding rate, which has been declining since the market crash on August 5th and reached -2.53% on Tuesday. Lunde wrote that this is the lowest level since March 2023.

Meanwhile, the nominal open interest over the past seven days has reached over 28,880 Bitcoins, the highest weekly record in over a year. Lunde wrote: "The current surge in open interest, combined with the 7-day average funding rate being negative, is unique and promising."

Advertisement

Funding rates are the regular payments made between traders in the futures market, especially for perpetual contracts with no expiration date. These rates are used to keep the perpetual contract prices aligned with spot prices. When the funding rate is positive, traders betting on price increases (long positions) pay fees to those betting on price decreases (short positions). Conversely, when the funding rate is negative, it reflects that more traders betting on price decreases are paying a significant fee to those betting on price increases.

Under normal market conditions, the funding rate fluctuates around 10.95%, Lunde wrote. However, when many people start to bet aggressively, the rate can deviate from expectations, typically showing a rush of traders towards the same bet. In recent days, Bitcoin prices have been significantly volatile as short interest increases.

However, according to a report by CoinTelegraph, some cryptocurrency analysts have indicated that popular trading indicators for Bitcoin are showing positive signals, which, if consistent with macro data, could force traders to act quickly and cover their positions.

"Technical indicators are improving, and with some traders holding short positions, this could trigger a short squeeze," said Markus Thielen, head of research at 10x Research, in a report on August 21.

In a report on August 18, CryptoQuant researcher Axel Adler mentioned two key indicators—the Bubble and Crash Market Structure and the ratio of the difference between market value and realized market value to the market value standard deviation (MVRV-Z score)—as signals of a healthy outlook for Bitcoin's current price trajectory.Adler added: "We can observe that the current bull market cycle is progressing quite steadily, without any significant anomalies or sharp jumps."

Currently, the U.S. spot Bitcoin ETF has maintained positive inflows on eight out of the last ten consecutive trading days. On August 20th, the total inflow into the ETF reached $88 million, the highest in two weeks.

Since the launch of the spot Bitcoin ETF IBIT in January this year, BlackRock has not recorded a single day of net outflows, except for May 1st.

According to Sam Baker, a researcher at the investment firm River, 60% of the largest hedge funds in the U.S. hold exposure to Bitcoin ETFs.

Lastly, it is noteworthy that since the introduction of the spot Bitcoin ETF, a clear pattern has emerged in Bitcoin's intraday trading: it appears that the perpetual futures market dominates the downside during the U.S. trading session, and then the ETF buys in at lower prices during the subsequent Asian and European trading sessions.

Post a comment